Section 80C: Tax Savings, Investments, and How to Maximize Your ₹1.5 Lakh Deduction

When you hear Section 80C, a provision under India’s Income Tax Act that lets you reduce your taxable income by investing in approved instruments. Also known as tax-saving investments, it’s not just a rule—it’s your biggest tool for keeping more of your hard-earned money. Every year, you can claim up to ₹1.5 lakh in deductions under this section, but only if you know where to put your money. It’s not about guessing. It’s about choosing the right mix of options that match your goals—whether that’s your child’s education, your retirement, or just building a safety net.

Many people think PPF, a government-backed long-term savings scheme with tax-free returns is the only option, but that’s not true. You’ve got SSY, a special scheme designed for girls’ education and marriage, offering higher interest than PPF, and ELSS, a mutual fund option that locks your money for just three years while offering market-linked growth. Then there’s EPF, life insurance premiums, tuition fees for kids, and even fixed deposits for five years. Each has its own rules, risks, and rewards. The key isn’t just to invest—it’s to invest smartly. For example, if you’re young and can handle some risk, ELSS might give you better returns over time. If you’re risk-averse and want guaranteed growth, PPF or SSY could be safer bets. And if you have a daughter, SSY isn’t just a tax break—it’s a financial head start.

Section 80C isn’t just about picking one thing. It’s about combining them. You don’t have to put all ₹1.5 lakh into one instrument. Split it. Put some in PPF for stability, some in ELSS for growth, and maybe a little in your child’s SSY account. The goal is to reduce your tax bill while building real wealth. And don’t forget: this deduction isn’t just for you. It applies to expenses like your kids’ school fees and even health insurance premiums if they’re under your name. That’s why it’s one of the most flexible tools in Indian tax planning.

What you’ll find below are clear, no-fluff guides that break down exactly how each option works—what the returns are, how long you need to lock your money, and which one fits your life right now. No jargon. No hype. Just what you need to know to make smarter choices with your ₹1.5 lakh.

Employee Provident Fund (EPF) in India: How Section 80C Deductions Save You Tax

Learn how EPF contributions under Section 80C can cut your income tax by up to ₹17,700 annually. Discover the rules, benefits, and common mistakes to avoid when claiming deductions.

Switching from Tax-Saving FD to ELSS in India: Process, Tax Implications & Timing Explained

Learn why you can't switch from tax-saving FD to ELSS before maturity, the correct process to move funds after lock-in ends, and key tax considerations. Get actionable steps for smarter tax planning under Section 80C.

ELSS Lock-in Period in India: Why the 3-Year Restriction Makes It Unique

ELSS tax-saving mutual funds in India have a unique 3-year lock-in period under Section 80C, offering higher returns than PPF or FDs while still providing tax benefits. Learn why this restriction makes ELSS the smartest choice for long-term wealth building.

Lock-In and Liquidity of 80C Options in India: What to Expect Before You Invest

Understand lock-in periods and liquidity in Section 80C tax-saving options like ELSS, PPF, NSC, and tax-saving FDs. Learn which investments let you access your money and which trap it for years.

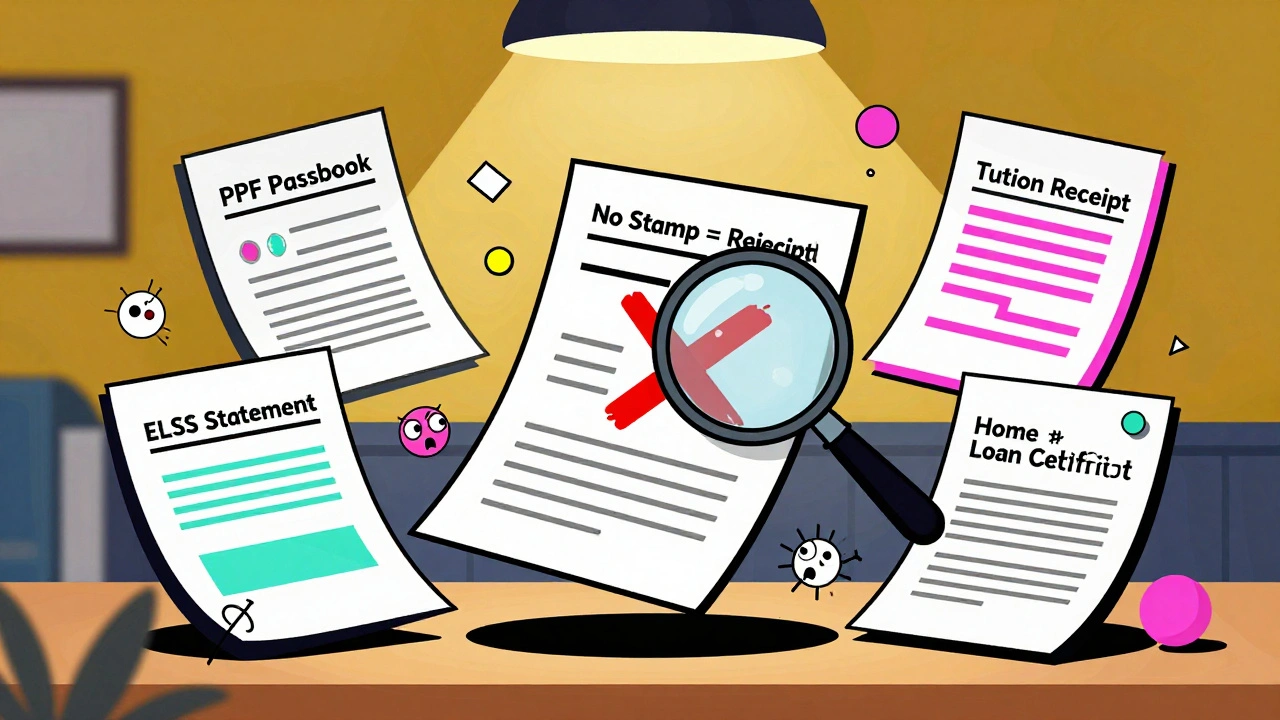

Section 80C Documentation Checklist in India: Proofs Required at Filing Time

Learn the exact documents required to claim Section 80C deductions in India. Avoid rejection with this verified checklist for PPF, ELSS, tuition fees, home loan, and more.

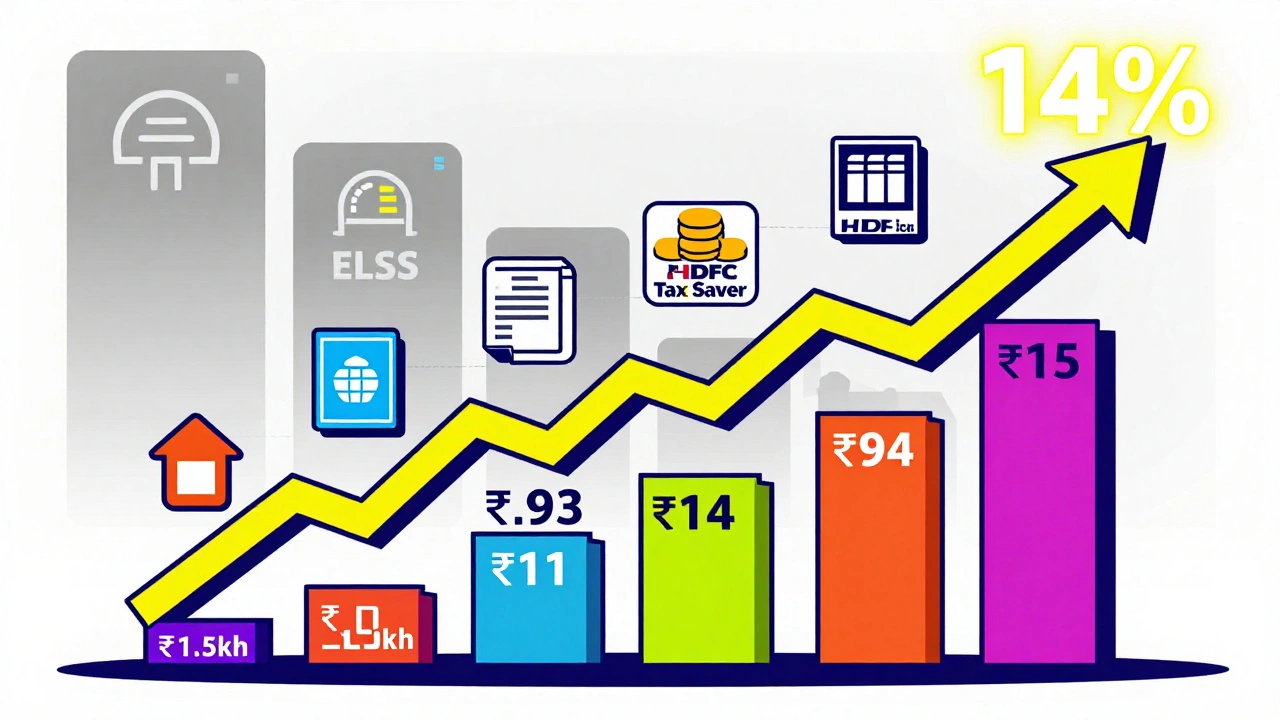

ELSS Fund Performance in India: Top Tax-Saving Mutual Funds with Highest Returns

Discover which ELSS mutual funds deliver the highest returns under Section 80C in India. Compare top performers, avoid common mistakes, and learn how to build tax-free wealth with equity-linked savings.

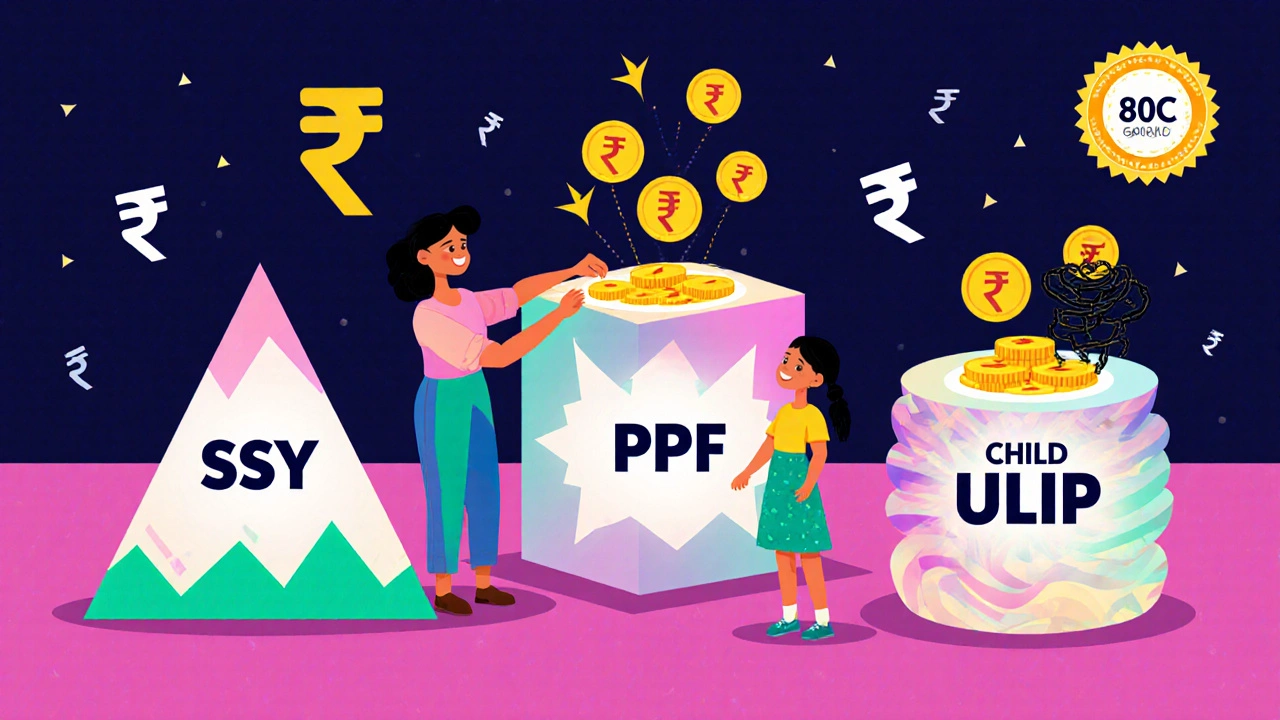

Section 80C and Children’s Plans in India: SSY vs Child ULIPs vs PPF

Compare SSY, PPF, and Child ULIPs under Section 80C to find the best tax-saving investment for your child's future in India. Learn which option offers higher returns, lower risk, and true financial security.

Section 80C vs 80D in India: Know the Difference Between Investment and Health Insurance Deductions

Understand the difference between Section 80C and Section 80D in India to maximize your tax savings. Learn how investment deductions and health insurance premiums can reduce your taxable income by up to ₹2.25 lakh annually.

Categories

- Cryptocurrency

- Careers & Education

- Home & Living

- Technology

- hire domestic help in Mumbai

- Home & Lifestyle

- hire drivers in mumbai

- hire pet care in mumbai

- Travel & Transportation

- Health & Fitness