Cryptocurrency: A Practical Guide to the Digital Money Landscape

When working with Cryptocurrency, digital assets secured by cryptography that operate without a central bank. Also known as crypto, it enables peer‑to‑peer value transfer across the internet, you’re actually stepping into a broader Blockchain, a distributed ledger that records every transaction in immutable blocks. One of the biggest platforms on this ledger is Ethereum, a programmable blockchain that runs smart contracts. Within Ethereum, MEV (Miner Extractable Value) refers to the profit miners can capture by reordering, inserting, or censoring transactions. In short, Cryptocurrency encompasses blockchain technology, includes Ethereum as a leading network, and is shaped by MEV dynamics that affect transaction ordering.

People jump into cryptocurrency because it promises faster, cheaper payments and new ways to earn online. You’ll hear terms like “smart contracts,” “decentralized finance,” and “token swapping” tossed around, but the core idea stays simple: move value without a middleman. That simplicity is what fuels the rapid growth we see in markets and why “crypto” feels both exciting and a bit confusing at first.

MEV, often called miner extractable value, is more than a technical footnote—it directly impacts the cost you pay when you send a transaction. When miners prioritize certain trades, you might see higher fees or slower confirmations. Understanding how MEV works helps you choose better gas strategies, like setting appropriate fees or using privacy‑preserving tools that hide your transaction details until they’re mined.

Beyond MEV, the Ethereum ecosystem showcases a slate of applications that run on its blockchain. Decentralized finance (DeFi) protocols let you lend, borrow, or earn interest without a bank, while non‑fungible tokens (NFTs) let creators tokenize art, music, or virtual land. All these services rely on the same underlying principles of trust‑less code execution that Ethereum introduced.

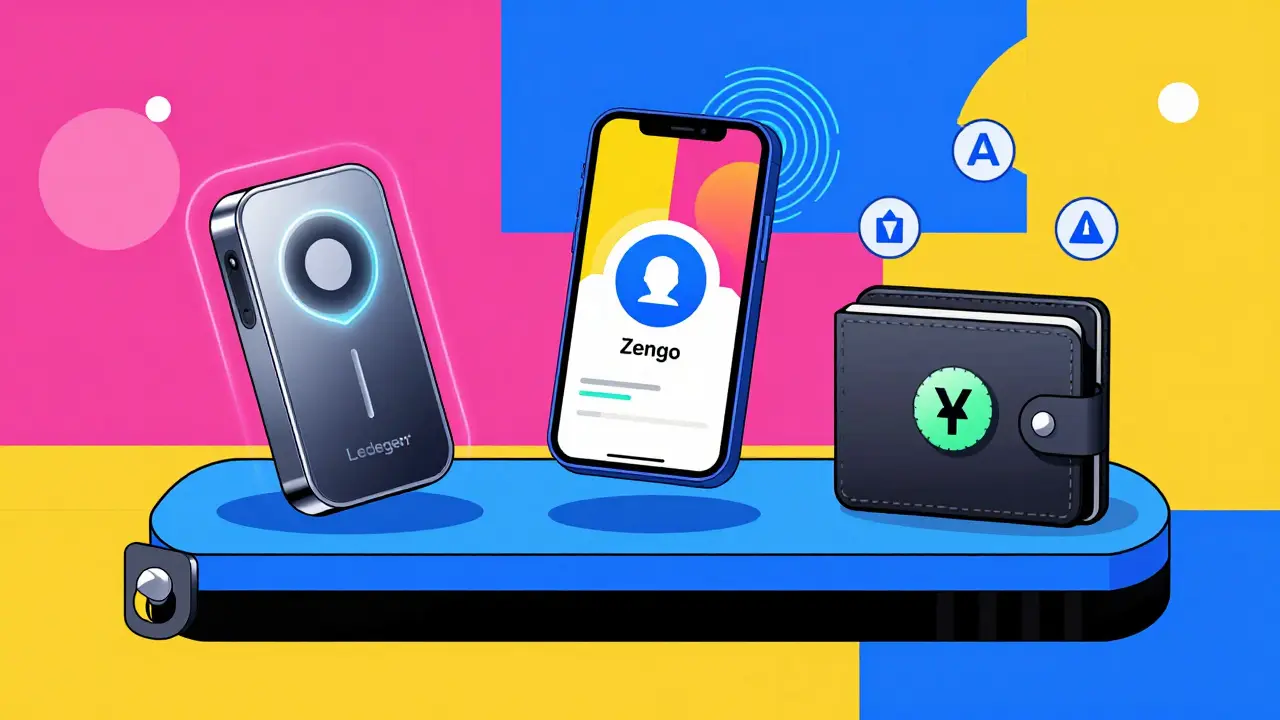

Security is a frequent worry, and rightfully so. Your private keys are the only thing that controls your crypto holdings, so using hardware wallets or reputable software wallets is a must. Also, be wary of phishing sites that mimic popular exchanges—once you hand over your seed phrase, the money is gone.

Current trends show a push toward scalability. Layer‑2 solutions like Optimism and Arbitrum bundle many transactions together, cutting fees and speeding up confirmations. Meanwhile, upgrades to Ethereum’s core, such as the shift to proof‑of‑stake, aim to reduce energy consumption and further lower costs.

Below you’ll find a hand‑picked collection of articles that dig deeper into these topics. For instance, our guide on Understanding MEV in Ethereum: A Complete Guide breaks down how front‑running works and what tools you can use to protect yourself. Whether you’re a beginner curious about how crypto works or an experienced user looking for the latest optimization tricks, the posts ahead cover the full spectrum.

Legal Entities for DAOs: Wyoming and Global Options

Wyoming offers the clearest legal path for DAOs to operate with liability protection, contract rights, and asset ownership. Learn how to form a DAO LLC, what DUNA is, and why global alternatives fall short.

Stablecoin Interest: Who Earns the Yield on Reserves

Stablecoin issuers like Circle and Tether earn billions in interest from reserve assets-but users get nothing. New yield-generating stablecoins like OUSD change that, offering real returns. Who really owns the money behind your stablecoin?

Bitcoin ETFs and Institutional Flows: How Big Money Is Changing the Market

Bitcoin ETFs have transformed institutional investing in crypto, turning Bitcoin from a speculative asset into a mainstream portfolio holding. Learn how big money is reshaping price behavior, liquidity, and market structure.

Stablecoin Adoption: Which Cryptocurrencies Are Winning in 2026

In 2026, USD Coin (USDC) and Tether (USD₮) dominate stablecoin adoption, powering global payments, DeFi lending, and cross-border remittances. With over 95% market share, they're the backbone of digital finance.

Understanding Margin Trading in India: Pledging, Leverage, and Peak Margin Rules

Margin trading in India lets you use pledged shares as collateral to trade with leverage. Understand peak margin rules, how pledging works, and why leverage can double your gains-or your losses.

Stock Splits and Bonus Shares in the Indian Market: What Investors Should Know

Understand how stock splits and bonus shares work in the Indian market. Learn why they don’t increase your wealth, how to spot them, and what to do when they happen - without falling for common myths.

WalletConnect Safety Guide: Approvals, Sessions, and Revocations Explained

WalletConnect keeps your crypto safe by requiring explicit approvals for every transaction, managing sessions securely, and allowing easy revocation. Learn how its Verify API blocks phishing attacks and why it's the top choice for 83% of wallets. Practical tips to avoid common security mistakes.

Crypto Bridges: Safe Cross-Chain Token Movement Guide (2026)

Crypto bridges enable secure token movement between blockchains. Learn how they work, types like custodial and trustless, security risks like the $325M Wormhole hack, and what to consider when choosing a bridge. Stay updated on market trends and future developments in cross-chain interoperability.

Web3 Wallets: MetaMask, Rainbow, and Top Alternatives Compared

Compare MetaMask, Rainbow Wallet, and top alternatives for Web3. Learn which wallet is best for DeFi, NFTs, security, and ease of use in 2025.

Secure Signing UX: How Human-Readable Transactions Prevent Crypto Losses

Human-readable transaction signing turns confusing crypto prompts into clear warnings, preventing users from accidentally giving away their funds. Learn how modern wallets are making security simple without sacrificing control.

Cross-Chain DEXs: Trade Any Crypto Pair Across Blockchains Without Intermediaries

Cross-chain DEXs let you trade native crypto assets across blockchains without centralized exchanges. Learn how THORChain, Chainflip, and Axelar work, their risks, benefits, and who should use them in 2026.

How to Choose the Best Crypto Wallet for Your Needs in 2026

Learn how to pick the right crypto wallet in 2026 based on your holdings, usage, and security needs. Compare hardware, mobile, and software wallets with real data and expert insights.

Categories

- Cryptocurrency

- Careers & Education

- Home & Living

- Technology

- Home & Lifestyle

- hire domestic help in Mumbai

- hire drivers in mumbai

- hire pet care in mumbai

- Travel & Transportation

- Health & Fitness