Archive: 2026/01 - Page 2

How to Start Investing in the Indian Stock Market: A Complete Beginner’s Guide

Learn how to start investing in the Indian stock market with zero experience. Open a Demat account, choose low-cost ETFs, avoid common mistakes, and build wealth slowly with SIPs. A simple guide for beginners.

The Future of Work: How DAOs Are Redefining Remote Teams

DAOs are reshaping remote work by replacing bosses with code, paychecks with tokens, and hierarchies with votes. Learn how these blockchain-based teams are changing the future of work-and how you can join one.

SCSS vs PMVVY in India: Which Senior Citizen Income Scheme Should You Choose?

Compare SCSS and PMVVY, two top government-backed retirement schemes in India. Learn which one offers better returns, tax benefits, and safety for senior citizens in 2026.

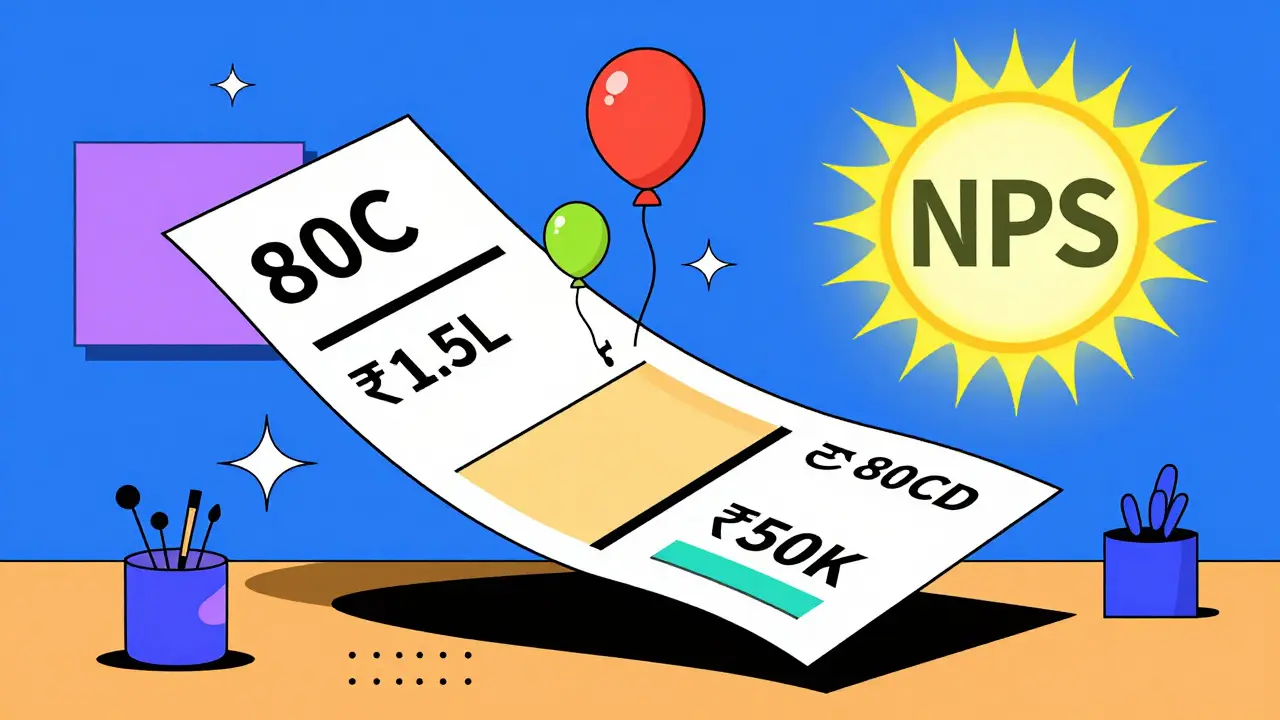

How to Combine Section 80C and 80CCD in India to Maximize Your Tax Deductions

Learn how to combine Section 80C and 80CCD in India to claim up to ₹2.5 lakh in tax deductions annually. Maximize savings with NPS, PPF, and employer contributions under current 2026 rules.

Understanding Index Rebalancing in India: How It Moves NIFTY and Sector Indices

Index rebalancing in India moves billions in capital every quarter. Learn how NIFTY 50 and sector indices like NIFTY Bank and NIFTY IT are adjusted, why stock prices shift, and how retail investors can use this predictable event to their advantage.

Public Provident Fund (PPF) in India: Complete Guide to the 15-Year Savings Scheme

The Public Provident Fund (PPF) is India's most trusted long-term savings scheme, offering tax-free returns, guaranteed interest, and a 15-year lock-in for secure retirement planning. Learn how it works, how to maximize it, and why it beats other options.

Healthcare Costs in Indian Retirement: Planning for Medical Inflation

Healthcare costs in India are rising faster than inflation, making retirement planning critical. Learn how much to save, which insurance works, and how to avoid financial strain as you age.

Sukanya Samriddhi Yojana (SSY) in India: Tax-Free Savings for a Girl Child

Sukanya Samriddhi Yojana (SSY) is a tax-free savings scheme in India for girls under 10, offering 8.2% interest and full 80C tax benefits. Ideal for education and marriage expenses, it guarantees returns and grows tax-free for 21 years.

How to Read Stock Charts: Technical Analysis Basics for Indian Investors

Learn how to read stock charts using technical analysis basics tailored for Indian investors. Understand candlesticks, support/resistance, volume, and patterns that actually work in Indian markets.

Retirement Planning for Women in India: Unique Considerations and Strategies

Retirement planning for women in India requires unique strategies due to longer lifespans, lower income, and limited access to assets. Learn how to use government schemes, build savings, and secure financial independence.

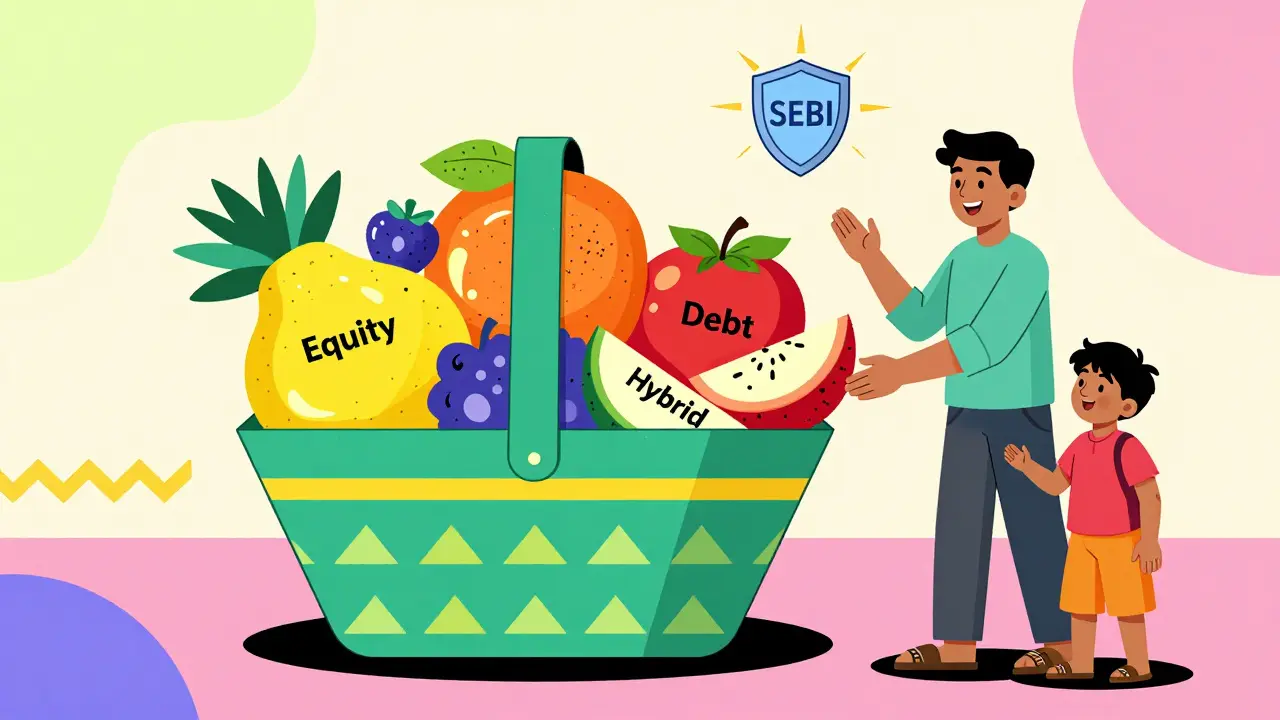

What Are Mutual Funds? A Complete Guide for Indian Investors

Mutual funds are the most practical way for Indian investors to grow wealth without needing expertise. Learn how they work, how to choose one, start a SIP, avoid common mistakes, and make your money work for you.

Categories

- Cryptocurrency

- Careers & Education

- Home & Living

- Technology

- Home & Lifestyle

- hire domestic help in Mumbai

- hire drivers in mumbai

- hire pet care in mumbai

- Travel & Transportation

- Health & Fitness