Careers & Education: Your Guide to Real Job Insights and What to Expect

Thinking about career options or curious about how people make everyday jobs work? You're in the right place. From pharmacists figuring out tough handwriting on prescriptions to pet teachers earning their way by training animals, this page breaks down what matters most when you're learning about careers and education.

How Pharmacists Decode Prescriptions Safely

Ever wondered how pharmacists read those nearly unreadable doctor handwriting notes? They do more than just guess. Pharmacists use their training and experience to spot errors and make sure you get the right medicine. This isn’t just about reading scribbles; it’s a critical step in keeping patients safe. Understanding this makes you appreciate the care behind every prescription you fill.

What Pet Teacher Salaries Look Like in India

Love animals? A career as a pet teacher or animal trainer could be for you. But how much do they really earn in India? Salaries vary—not just by location but by the skills and experience trainers bring. We break down the numbers so you know what to expect and how you can boost your earnings if you decide to go this route.

Whether you want career facts or salary details, knowing the real deal helps you make smart choices. Scroll through the posts here for useful info that’s straightforward and easy to understand, giving you a clear picture of what stepping into these jobs looks like.

ULIPs Under Section 80C in India: Premium Limits, Returns, and Tax Treatment

ULIPs under Section 80C in India offer tax savings but come with strict limits, high charges, and hidden tax traps. Learn how premium caps, returns, and maturity rules affect your real returns - and what alternatives give better value.

Employee Provident Fund (EPF) in India: How Section 80C Deductions Save You Tax

Learn how EPF contributions under Section 80C can cut your income tax by up to ₹17,700 annually. Discover the rules, benefits, and common mistakes to avoid when claiming deductions.

Switching from Tax-Saving FD to ELSS in India: Process, Tax Implications & Timing Explained

Learn why you can't switch from tax-saving FD to ELSS before maturity, the correct process to move funds after lock-in ends, and key tax considerations. Get actionable steps for smarter tax planning under Section 80C.

How to Track Mutual Fund Performance in India and Evaluate Your Portfolio

Learn how to track mutual fund performance in India, evaluate your portfolio, and make smarter investment decisions with practical steps, benchmarks, and tools. Avoid common mistakes and beat inflation with confidence.

PPF Partial Withdrawal Rules in India: Limits, Timelines, and Strategies

Learn the exact rules for partial PPF withdrawals in India - when you can take money out, how much you’re allowed, and smart strategies to avoid losing out on interest and tax benefits.

How to Start Investing in the Indian Stock Market: A Complete Beginner’s Guide

Learn how to start investing in the Indian stock market with zero experience. Open a Demat account, choose low-cost ETFs, avoid common mistakes, and build wealth slowly with SIPs. A simple guide for beginners.

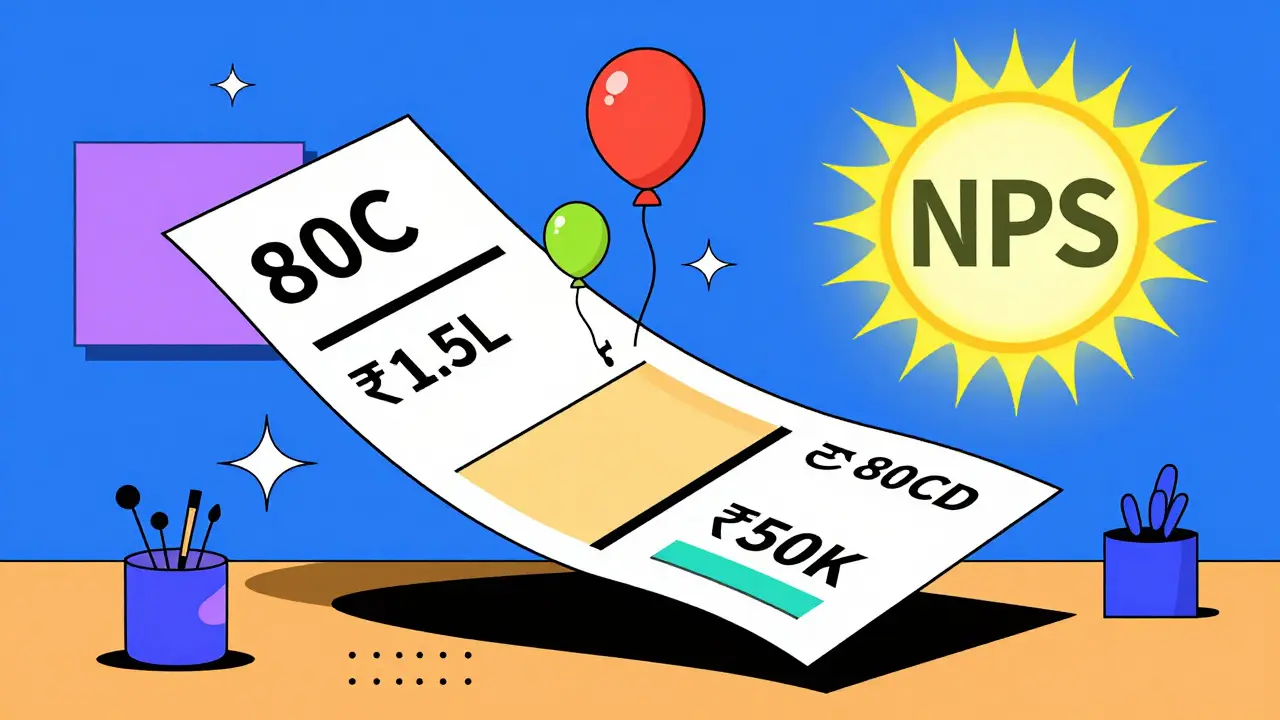

How to Combine Section 80C and 80CCD in India to Maximize Your Tax Deductions

Learn how to combine Section 80C and 80CCD in India to claim up to ₹2.5 lakh in tax deductions annually. Maximize savings with NPS, PPF, and employer contributions under current 2026 rules.

Public Provident Fund (PPF) in India: Complete Guide to the 15-Year Savings Scheme

The Public Provident Fund (PPF) is India's most trusted long-term savings scheme, offering tax-free returns, guaranteed interest, and a 15-year lock-in for secure retirement planning. Learn how it works, how to maximize it, and why it beats other options.

Sukanya Samriddhi Yojana (SSY) in India: Tax-Free Savings for a Girl Child

Sukanya Samriddhi Yojana (SSY) is a tax-free savings scheme in India for girls under 10, offering 8.2% interest and full 80C tax benefits. Ideal for education and marriage expenses, it guarantees returns and grows tax-free for 21 years.

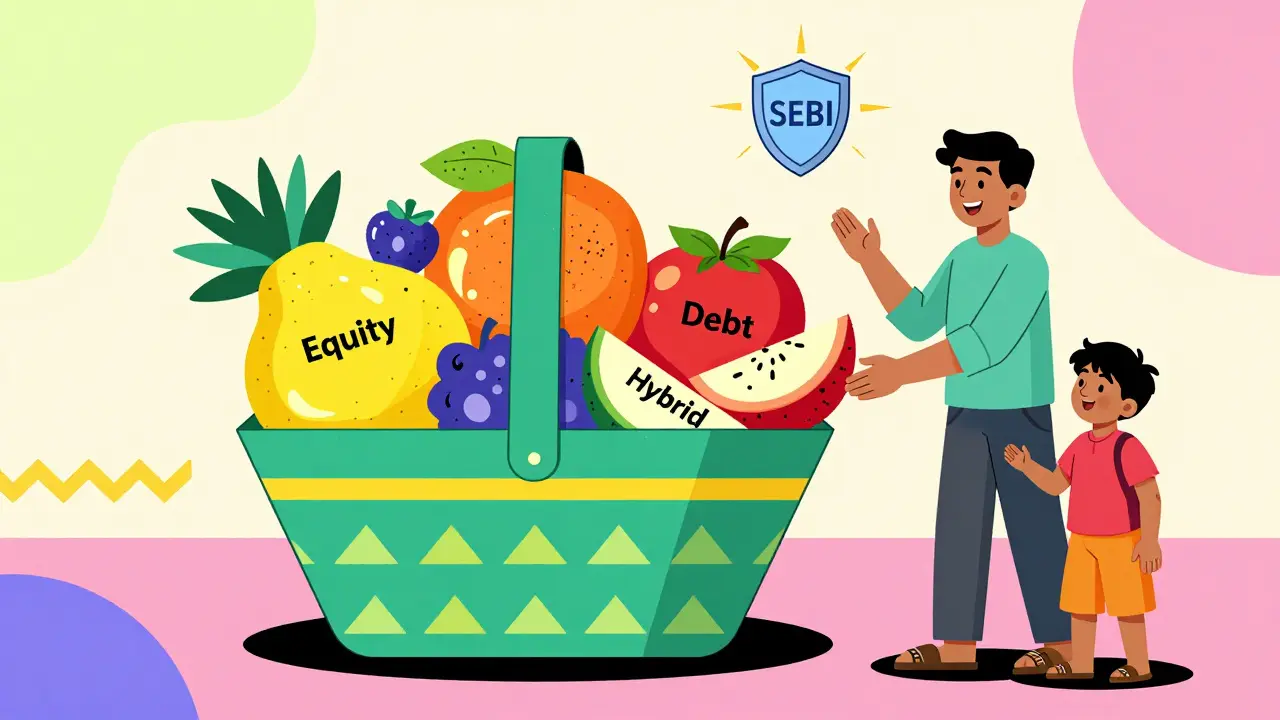

What Are Mutual Funds? A Complete Guide for Indian Investors

Mutual funds are the most practical way for Indian investors to grow wealth without needing expertise. Learn how they work, how to choose one, start a SIP, avoid common mistakes, and make your money work for you.

Rupee Cost Averaging in India: Why SIPs Work for Long-Term Investing

Rupee cost averaging through SIPs helps Indian investors build wealth over time without timing the market. Learn why consistent monthly investing in mutual funds beats lump-sum investing and how to start smart.

ELSS Lock-in Period in India: Why the 3-Year Restriction Makes It Unique

ELSS tax-saving mutual funds in India have a unique 3-year lock-in period under Section 80C, offering higher returns than PPF or FDs while still providing tax benefits. Learn why this restriction makes ELSS the smartest choice for long-term wealth building.

Categories

- Cryptocurrency

- Careers & Education

- Home & Living

- Technology

- hire domestic help in Mumbai

- Home & Lifestyle

- hire drivers in mumbai

- hire pet care in mumbai

- Travel & Transportation

- Health & Fitness