TaskAssist - Page 5

ELSS Lock-in Period in India: Why the 3-Year Restriction Makes It Unique

ELSS tax-saving mutual funds in India have a unique 3-year lock-in period under Section 80C, offering higher returns than PPF or FDs while still providing tax benefits. Learn why this restriction makes ELSS the smartest choice for long-term wealth building.

Checklist Before You List: What Every Seller Should Know Before Putting Their Home on the Market

A comprehensive checklist to prepare your home for sale, covering decluttering, repairs, staging, pricing, and professional photos. Learn what actually moves the needle in today’s market and how to avoid common seller mistakes.

What Is Bitcoin: The Original Cryptocurrency Explained

Bitcoin is the first decentralized digital currency, created in 2009. It operates without banks, uses blockchain technology, and has a fixed supply of 21 million coins. Learn how it works, its risks, and why it matters today.

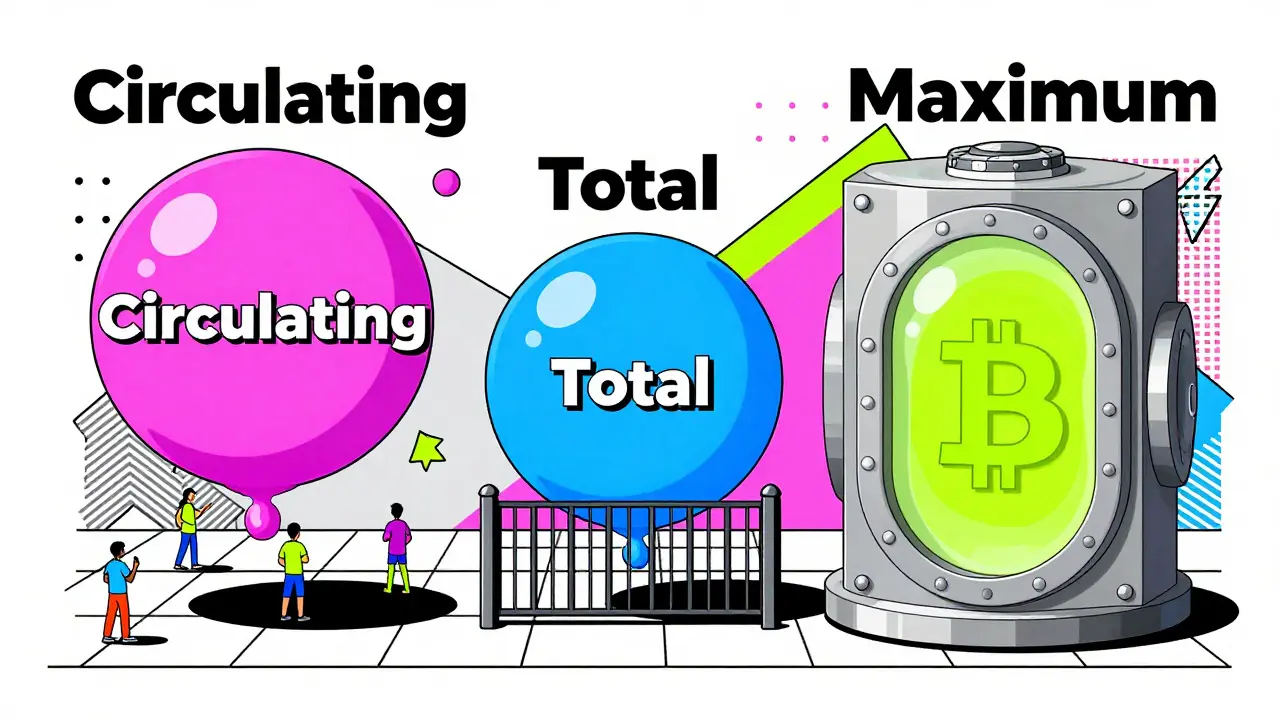

Token Supply Explained: Maximum, Circulating, and Total Supply in Crypto

Understand the three key token supply metrics - circulating, total, and maximum - to avoid costly crypto investing mistakes. Learn how they affect price, valuation, and long-term scarcity.

Lock-In and Liquidity of 80C Options in India: What to Expect Before You Invest

Understand lock-in periods and liquidity in Section 80C tax-saving options like ELSS, PPF, NSC, and tax-saving FDs. Learn which investments let you access your money and which trap it for years.

National Savings Certificate (NSC) in India: Government-Backed 80C Investment Option

National Savings Certificate (NSC) in India offers a government-backed, tax-saving investment under Section 80C with a 7.7% interest rate and 5-year lock-in. Ideal for risk-averse investors seeking guaranteed returns and tax deductions.

How to Avoid Mutual Fund Mis-Selling in India: Red Flags and Due Diligence

Learn how to spot mutual fund mis-selling in India, avoid common traps, and protect your investments with simple due diligence steps. Know the red flags and how to choose the right fund.

Custodial vs. Self-Custody in Crypto: Which Gives You Real Security and Control?

Custodial and self-custody wallets offer different trade-offs in security, control, and convenience. Learn which one suits your crypto holdings and how to protect your assets long-term.

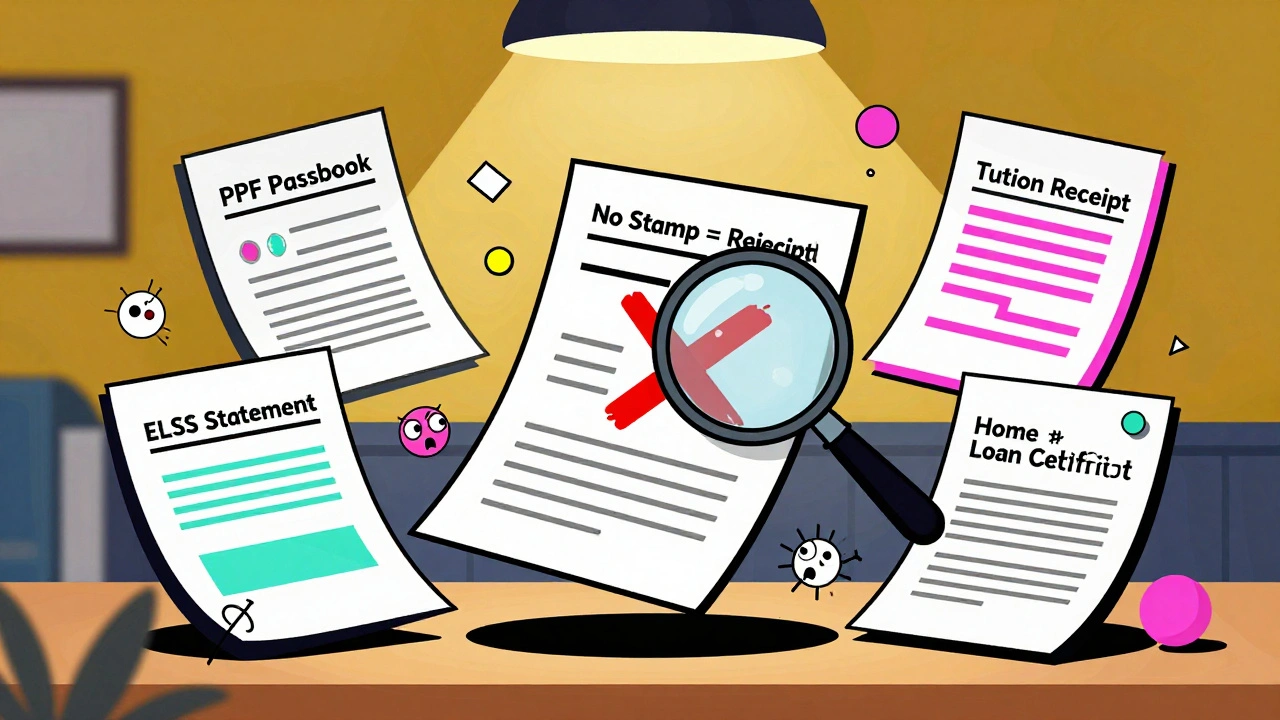

Section 80C Documentation Checklist in India: Proofs Required at Filing Time

Learn the exact documents required to claim Section 80C deductions in India. Avoid rejection with this verified checklist for PPF, ELSS, tuition fees, home loan, and more.

Smart Contract Risks: How to Evaluate Audit Reports and Admin Key Controls

Smart contract audits don't guarantee safety-they just show what was checked at one moment. Learn how to read audit reports, spot admin key risks, and avoid the most common traps that lead to $1.3 billion in losses.

Cognitive Biases in Crypto Trading: How Anchoring, Recency, and Sunk Cost Cost You Money

Anchoring, recency, and sunk cost biases are destroying crypto traders' returns. Learn how these mental traps work, why crypto makes them worse, and how to build systems that protect your capital.

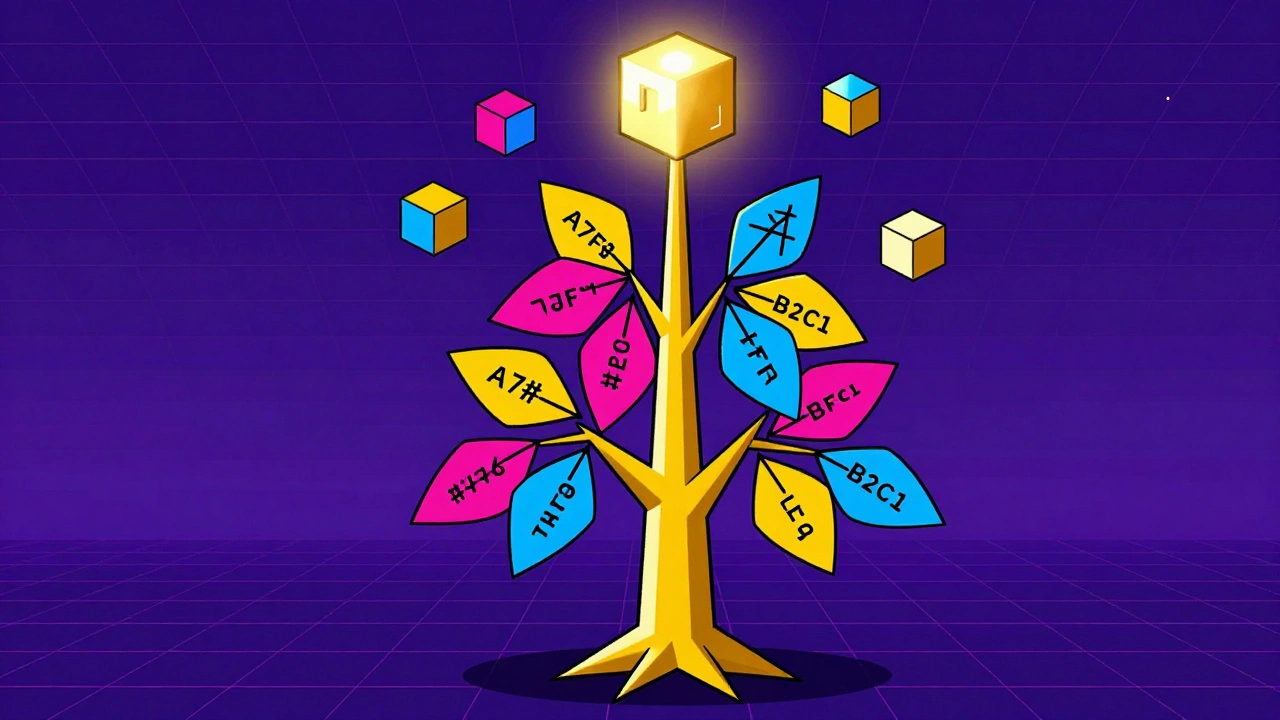

How Merkle Trees Secure Cryptocurrency Transactions on the Blockchain

Merkle trees are the hidden backbone of blockchain security, allowing cryptocurrencies like Bitcoin to verify transactions quickly and securely without storing all data. Learn how Merkle roots make crypto trustless and scalable.

Categories

- Cryptocurrency

- Careers & Education

- Home & Living

- Technology

- Home & Lifestyle

- hire domestic help in Mumbai

- hire drivers in mumbai

- hire pet care in mumbai

- Travel & Transportation

- Health & Fitness